Empowering India With Financial Literacy

Empowering India With Financial Literacy

Empowering India With Financial Literacy

Achieve Financial Goal

Is

Efficiently

Effectually

Proficiently

Efficiently

Effectually

Proficiently

A good strategy is a strategy that can successfully lead the business in a more developed direction.

We’ve worked on over 200 projects with 150+ clients

Our Vision / Mission

Across India, young people graduate without the basic financial skills needed to navigate adulthood. For underserved communities, this lack of financial education can deepen cycles of vulnerability, limit opportunity, and create long-lasting economic dependence. The consequences are real — students enter the world without knowing how to budget, save, avoid debt traps, or plan for their futures.

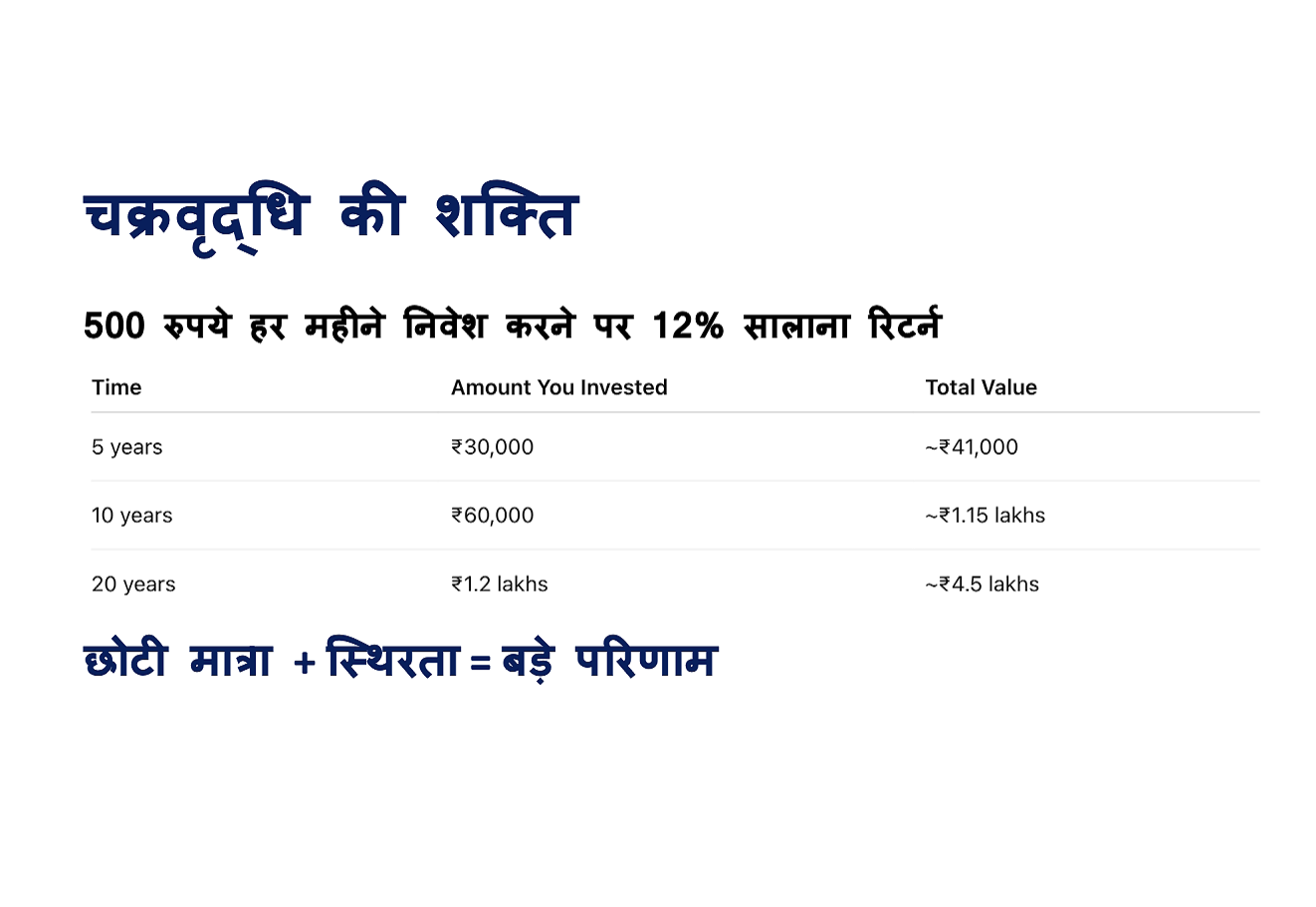

Project Sampatti was created to close this gap. We equip students with practical, culturally relevant financial education through interactive workshops, structured curriculum, and community partnerships. Our programs build confidence, improve decision-making, and provide tools students can apply immediately in their lives — from budgeting and saving to understanding banking, credit, and career planning.

We believe financial literacy is a fundamental life skill that every young person deserves access to. When students understand money, they unlock agency: the ability to shape their futures, support their families, and break generational cycles. Our mission is simple — to make financial knowledge accessible to every student in India and to build long-term economic resilience, one classroom at a time.

Our Core Values

We teach with empathy and understanding, recognizing financial pressures many learners face. Our approach prioritizes respect, dignity, and emotional safety while delivering practical, supportive financial skills for all students.

Money often feels complex and overwhelming because of jargon. We simplify financial concepts into clear, practical lessons students easily understand and apply directly in their everyday lives today confidently.

Financial literacy builds confidence and personal agency. We equip young people with skills to make informed decisions, advocate for themselves, and shape independent futures without fear or dependence freely.

We deliver transparent, unbiased, research-backed financial education grounded in real data. Our curriculum follows ethical principles and remains free from commercial influence, promotions, hidden incentives, or agenda-driven messaging always.

We measure success through lasting change rather than attendance. Our programs build strong financial habits, improve decision-making, and create positive outcomes for students, families, communities, and long-term economic resilience.

Financial knowledge should be available to everyone, regardless of privilege, education, or resources. We create inclusive, relatable content so students from all backgrounds can participate confidently and benefit fully.

Our Programs

Guest Lecture Series

In-person sessions for schools, community centers, and youth groups. Designed to be interactive, relevant, and easy to apply in daily life.

Curriculum Development

Customized financial literacy curricula, lesson plans, and teaching materials that institutions can deliver independently, ensuring consistent and sustainable learning.

Non Profit Partnerships

Tailored modules for NGOs, schools, and foundations working with students or underprivileged communities.

Our Vision / Mission

Across India, young people graduate without the basic financial skills needed to navigate adulthood. For underserved communities, this lack of financial education can deepen cycles of vulnerability, limit opportunity, and create long-lasting economic dependence. The consequences are real — students enter the world without knowing how to budget, save, avoid debt traps, or plan for their futures.

Project Sampatti was created to close this gap. We equip students with practical, culturally relevant financial education through interactive workshops, structured curriculum, and community partnerships. Our programs build confidence, improve decision-making, and provide tools students can apply immediately in their lives — from budgeting and saving to understanding banking, credit, and career planning.

We believe financial literacy is a fundamental life skill that every young person deserves access to. When students understand money, they unlock agency: the ability to shape their futures, support their families, and break generational cycles. Our mission is simple — to make financial knowledge accessible to every student in India and to build long-term economic resilience, one classroom at a time.

The Future Of Financial Service Place

- Mission

- Vision

To equip young Indians — especially students from underserved backgrounds — with essential financial skills that enable independence, informed decision-making, and long-term economic well-being.

An India where every student, regardless of background, grows up financially confident, capable, and empowered to create a prosperous future.

Our Financial Experts

Our Process

Submit a Workshop Request

Customize the Session

Conduct the Workshop

Certificates & Learning Materials

Join Thousands of Satisfied Customers

"Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris."

Alva Edision

Join Thousands of Satisfied Customers

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris."